|

Reading two very different books has set me to a bit of thinking. One was Mariana Mazzucato's The Value of Everything and the other Tom Devine's To the Ends of the Earth.

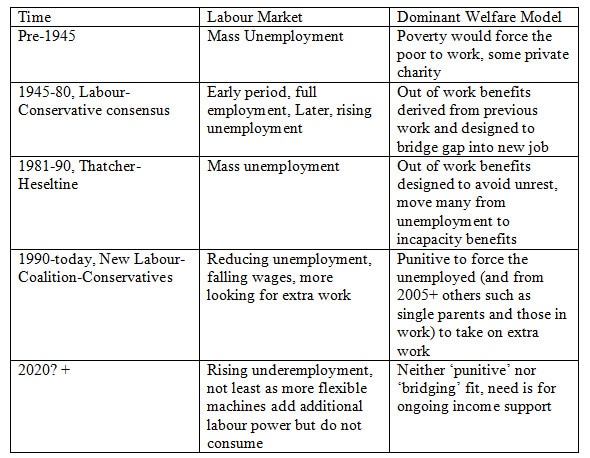

Mazzucato focuses primarily on how we define value and how this in turn defines what constitutes economic development. She rightly notes how this essential debate was deliberately closed off by the marginalist (or neo-classical) economics developed in the 1890s. This left us with no tool other than to accept that if a good, or an activity, had a price, then by definition it had value. So asset stripping, speculative investment and rent seeking are all 'valueable' purely as they can command a price. This is now so embedded in modern economics teaching that it is hard to remember the debates that dominated the profession in the period 1750-1890 (including Adam Smith) as to what was, and what was not, productive (and thus of value). Devine, at one glance, has no engagement with this debate. His book is a fascinating take on migration from Scotland and does an excellent job of debunking Prebble's lugubrious focus on the Highland Clearances. Most of the Scottish diaspora was voluntary, mainly a product of seeking to escape the low wages that were endemic in Victorian Scotland by people with some assets (note that here I am not arguing that the clearances were anything but an act of organised brutality which has left a permanent scar on Scotland) and often marked by both leaving and returning (unlike say nineteenth century Irish migration). The key issue is the impact of those low wages. Not only did this drive migration it had a catastrophic effect on the development of Scottish industry. By the 1860s, Scotland had an ideal version of a classic mid-Victorian economy. Heavy industry developed as raw materials, power and transport links were all close by. Add on an educational system that valued practical skills and it had ready access to suitable skilled labour. However, domestic demand was low (due to lack of wages) and most production was exported. More critically, low demand meant low levels of domestic reinvestment. Devine suggests that the value of exported capital from Scotland in 1870 was £60m and by 1914 this was £500m. At the same time the Scottish economy stagnated due to lack of investment and didn't make the transition to production of consumer goods (or to light industry). Taking a step forward, by the early 1980s this meant an industrial sector that was almost a century out of date. To draw on one of Marx's insights, initially production for other producers, and export to the British Empire, masked weaknesses in domestic consumer demand. However, in the end low wages led to an unbalanced economy, especially as much investment was speculative in the search of short term gains rather for long term production. And, this is now far worse. We have a narrative where profits are seen as a reward for activity (any activity as we have the fallacy of price=value embedded by conventional economics) but wages are a cost. So business commentators will earnestly discuss this or that fall in profits but never mention the consequences of another fall in wages (apart from in the context of needed 'cost-cutting'). In reality, we need a high wage economy to sustain its ongoing development - and ability to transform to meet a new economic paradigm of resource shortage and the need to curtail excess usage. But, as in the 1890s, the needed capital goes in search of short term returns, rent extraction and capturing wealth (rather than its production). In effect, we have raised the fallacy that high wages are a consequence of a successful economy to being beyond question. The reality is that high wages are actually the basis for a successful economy. And in a Scottish context we only need to look at our own relatively recent history. If the Victorian industrialists had been less zealous in suppressing Trades Unions and wages, the Scottish economy would have developed more incrementally as opposed to becoming stuck in a model that was increasingly outdated. And, to return to Mazzucato's arguments, we need a serious discussion about what actually creates value. It really is time to leave the theories of the 1890s where they belong, in discussions about the history and development of economic thought. The concept of Universal Basic Income (UBI) is gaining substantial attention recently. It has existed for some time and is often described as a policy supported by both right and left wing economists. However, this support across ideology has actually led to considerable confusion about what is really meant by UBI and how it might work in practice.. To its supporters, the logic behind UBI is compelling. It will enable citizens to make informed choices about how they allocate their time. It will provide a balance against exploitative employers who seek to leave their workers without a decent income. In addition, it will create the basis for an expansion in human creativity as people have the means to pursue long term plans rather than worry about their immediate income. The practical problem though is that UBI is actually being used to cover at least 3 very different schemes. If we are not sure which we are proposing then its implementation will be every bit as flawed as current social security and welfare systems. So lets look at the main variants and their advantages and problems. UBI as Vouchers or to replace Wages? UBI has always been attractive to the Libertarian Right. However, we need to be clear what they mean and how it would work in their approach. A key belief for this group is that, in some never explained way, competition will improve the delivery of public services and vouchers are often their preferred means to deliver this. The idea is that people will use these vouchers to buy their education, health care, and other key services. Thus when they speak about UBI what they mean is a different means to buy services that in most Western democracies are provided out of general taxation. In effect it is a rejection of the concept of univeralism and shared risks that underpins all Western European welfare states. The recent interest in UBI among the leaders of hi-tech firms and the rich and powerful who meet at Davos should be another cautionary warning. While they are responding to the threat that automation will reduce the amount of paid work available, fundamentally their interest is that a UBI scheme will reduce the amount they need to pay in wages. In effect they can transfer the cost of employment from their companies to the tax payer. There is recent UK evidence to suggest that employers will take advantage of any expected state support for income to reduce wages. Former Labour Party PM Gordon Brown, when he was Chancellor of Exchequer, introduced the concept of 'tax credits' to shore up the income of those in work but whose wages were low. The policy was badly flawed from the start with all the hallmarks of a Brown scheme. Complex, assuming the peoples' lives fitted his policy framework, the immediate effect was to land many people with limited income large income tax demands. Equally the scheme led to employers reducing wages as they shifted the cost of employment from wages to the tax payer. The result was a massive increase in the cost of the scheme. UBI as a Social Security System More recently there have been a number of practical experiments in UBI. Finland has an ongoing experiment as does the Dutch city of Utrecht. The common thread to both these, and other recent proposals such as in Scotland. is that the prime focus is on those who are unemployed. While there is consideration of how UBI will interact with waged employment, primarily such schemes aim to end the current problems of too complex welfare systems based around punitive rates of benefits. While there is a clear need for such a fundamental rethink, it is not immediately clear how such systems will really address the problem of increasing lack of work for many. The post-2008 work force is characterised not by unemployment as such but periods of under-employment and low wages. All the evidence is that this will increase due to lack of work place legal rights, weakened Trades Unions and the continued expansion of automation. In this context, UBI becomes the basis of a new model of social welfare interacting with a different world of work. For the UK since the 1930s, it is possible to track the relationship between welfare and work as: In effect UBI is a welfare model that fits a world of regular under-employment and periods of no work. It reflects the view that the punitive model has been a failure and the bridging model too optimistic as under-employment is becoming endemic.

However, it also means that employers feel they can reduce wages and there is evidence from the Finnish experiment that this is happening. While the identity of the recipients are secret, it is not hard to work out who is in receipt of UBI. Employers are treating the UBI as the first tranch of wages. In effect as with the UK experiment with working family tax credits, the known existence of state support is used to justify paying lower wages. UBI in practice We need to be clear about the emerging world of work. Wages are going to be depressed as more of the share of wealth is taken by those able to extract rents from the productive process. This means that we need a different tool to ensure that people have the income security needed to sustain a basic standard of living. As of 2016, in the UK, the Joseph Rowntree Foundation suggested this was around £17,100 per annum for a single person. To place this in context, most UBI schemes seem to suggest a payment of £1000 a month and the current basic UK benefit (Universal Credit) gives an annual income of around £4,500 (per annum). It is clear that UBI, as currently formulated, has flaws. We must reject the apparent support of the libertarian right. To them it is simply a tool to undermine what is left of universal social provision or to justify paying lower wages. Equally the current practical debate is in truth about creating a social security system that works for the emerging labour market. This is valid and much needed, but UBI was proposed as something different to social security. If it is to deliver on the hopes of its more committed proponents, there is a need to think much more carefully about the interaction of UBI, wages and work. Much of the discussion in terms of the impact of new technology on manufacturing jobs concentrates on the impact of advanced robotics and improved machine learning. From this perspective, the core assumption is that manufacturing continues much as now but with a shift from human to robotic labour. In the optimistic scenarios, this will lead to lower costs, higher output (so the increased demand will generate new jobs) and overall more social wealth. More pessimistic observers tend to argue that there is no evidence that demand will expand (not least due to the uneven income distribution we already have and depressed wages) and that this will lead to a reduction in human employment. Even the IMF is now deeply concerned at the threat to wages and overall social equality. Overlooked in this focus on automation is a shift in how production itself is changing. 3-D printers are relatively new but are becoming much cheaper to run and increasingly sophisticated. Production relies on the existence of raw materials (usually but not exclusively some form of plastics) that can be cut to shape and printed – either as a complete product or then finished later in the manufacture process. The technology offers real advantages in terms of personalisation of the output (it has started to be used to produce artificial limbs etc), that it further reduces the needs to hold inventories (as new stock can literally be produced to order) and that production becomes much less dependent on large scale power sources or access to raw materials. The implications are mostly positive but with some caveats. It allows an economy to decentralise (important for a country such as Scotland with a large land area and relatively low population density). It makes it possible to manufacture in remote areas – something that is important in terms of renewable energy production where the best sites for solar, wind or wave energy production are often quite remote. At the moment, it remains a relatively technical process (in that there is a need to design and finish any item) but this maybe changing either as complete kits are available to download or standardised approaches are developed. If this does take off, the scope for SMEs (and individuals) to generate complex and substantial manufactured goods will exist. However, this reduces the costs of production and thus the ability to generate conventional profits and wages. As with the changes in information production and sharing this then raises the issue of where in a production chain can any rent or other earnings be extracted. Control of copyright may become important as this can affect both the original equipment and any designs in use, as will be supply of raw materials. So this may see manufacture shift its costs (and thus earned income) from the production process to the creation of raw materials (including power) and possession of the licences required. This in turn leads to a discussion about how work and production is organised. On the one hand, there is scope for much more shared control over the process of production, on the other hand as production costs (and thus income) fall then earning wages from the work becomes less practical. If we carry on seeing wages as a cost of production as opposed to a reward derived from that production, then the future seems to be one of increasingly precarious income for many combined with the accumulation of wealth not by those who provide the capital but by those who can find ways to erect methods to extract rent (by providing the routes for activity or via control of patents). This suggests that as opposed to allowing those who can create such gateways to accumulate the wealth there is a need to think of means to either break apart these bottlenecks or to ensure that the monies currently being accrued as rent are shared with wages. Even the IMF are now concerned that unmanaged introduction of further automation will lead to unsustainable levels of poverty. If it proves (and this maybe unlikely) that machines and humans become perfectly replaceable, then wages will fall even if overall output rises (at the least there are more ‘workers’ and the expansion of output cannot compensate). If machines can replace many jobs then at some stage wages for those in skilled (hard to substitute) work will increase in the longer term but for many wages and employment will fall. Roger Cook |

AuthorMost of the material here reflects ongoing research projects .. or just musing about the writing process Archives

September 2019

Categories

All

|

Proudly powered by Weebly

RSS Feed

RSS Feed