|

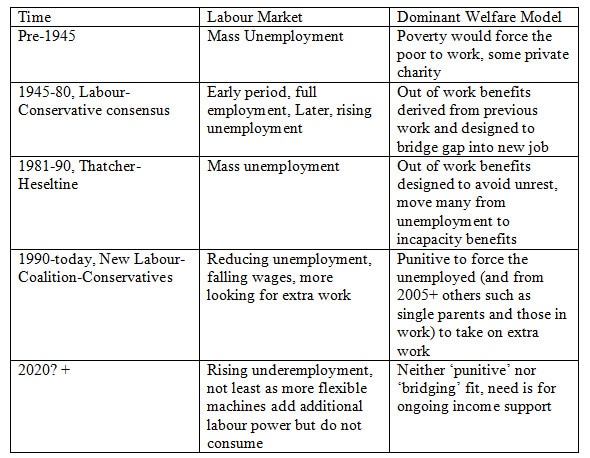

The concept of Universal Basic Income (UBI) is gaining substantial attention recently. It has existed for some time and is often described as a policy supported by both right and left wing economists. However, this support across ideology has actually led to considerable confusion about what is really meant by UBI and how it might work in practice.. To its supporters, the logic behind UBI is compelling. It will enable citizens to make informed choices about how they allocate their time. It will provide a balance against exploitative employers who seek to leave their workers without a decent income. In addition, it will create the basis for an expansion in human creativity as people have the means to pursue long term plans rather than worry about their immediate income. The practical problem though is that UBI is actually being used to cover at least 3 very different schemes. If we are not sure which we are proposing then its implementation will be every bit as flawed as current social security and welfare systems. So lets look at the main variants and their advantages and problems. UBI as Vouchers or to replace Wages? UBI has always been attractive to the Libertarian Right. However, we need to be clear what they mean and how it would work in their approach. A key belief for this group is that, in some never explained way, competition will improve the delivery of public services and vouchers are often their preferred means to deliver this. The idea is that people will use these vouchers to buy their education, health care, and other key services. Thus when they speak about UBI what they mean is a different means to buy services that in most Western democracies are provided out of general taxation. In effect it is a rejection of the concept of univeralism and shared risks that underpins all Western European welfare states. The recent interest in UBI among the leaders of hi-tech firms and the rich and powerful who meet at Davos should be another cautionary warning. While they are responding to the threat that automation will reduce the amount of paid work available, fundamentally their interest is that a UBI scheme will reduce the amount they need to pay in wages. In effect they can transfer the cost of employment from their companies to the tax payer. There is recent UK evidence to suggest that employers will take advantage of any expected state support for income to reduce wages. Former Labour Party PM Gordon Brown, when he was Chancellor of Exchequer, introduced the concept of 'tax credits' to shore up the income of those in work but whose wages were low. The policy was badly flawed from the start with all the hallmarks of a Brown scheme. Complex, assuming the peoples' lives fitted his policy framework, the immediate effect was to land many people with limited income large income tax demands. Equally the scheme led to employers reducing wages as they shifted the cost of employment from wages to the tax payer. The result was a massive increase in the cost of the scheme. UBI as a Social Security System More recently there have been a number of practical experiments in UBI. Finland has an ongoing experiment as does the Dutch city of Utrecht. The common thread to both these, and other recent proposals such as in Scotland. is that the prime focus is on those who are unemployed. While there is consideration of how UBI will interact with waged employment, primarily such schemes aim to end the current problems of too complex welfare systems based around punitive rates of benefits. While there is a clear need for such a fundamental rethink, it is not immediately clear how such systems will really address the problem of increasing lack of work for many. The post-2008 work force is characterised not by unemployment as such but periods of under-employment and low wages. All the evidence is that this will increase due to lack of work place legal rights, weakened Trades Unions and the continued expansion of automation. In this context, UBI becomes the basis of a new model of social welfare interacting with a different world of work. For the UK since the 1930s, it is possible to track the relationship between welfare and work as: In effect UBI is a welfare model that fits a world of regular under-employment and periods of no work. It reflects the view that the punitive model has been a failure and the bridging model too optimistic as under-employment is becoming endemic.

However, it also means that employers feel they can reduce wages and there is evidence from the Finnish experiment that this is happening. While the identity of the recipients are secret, it is not hard to work out who is in receipt of UBI. Employers are treating the UBI as the first tranch of wages. In effect as with the UK experiment with working family tax credits, the known existence of state support is used to justify paying lower wages. UBI in practice We need to be clear about the emerging world of work. Wages are going to be depressed as more of the share of wealth is taken by those able to extract rents from the productive process. This means that we need a different tool to ensure that people have the income security needed to sustain a basic standard of living. As of 2016, in the UK, the Joseph Rowntree Foundation suggested this was around £17,100 per annum for a single person. To place this in context, most UBI schemes seem to suggest a payment of £1000 a month and the current basic UK benefit (Universal Credit) gives an annual income of around £4,500 (per annum). It is clear that UBI, as currently formulated, has flaws. We must reject the apparent support of the libertarian right. To them it is simply a tool to undermine what is left of universal social provision or to justify paying lower wages. Equally the current practical debate is in truth about creating a social security system that works for the emerging labour market. This is valid and much needed, but UBI was proposed as something different to social security. If it is to deliver on the hopes of its more committed proponents, there is a need to think much more carefully about the interaction of UBI, wages and work. |

AuthorMost of the material here reflects ongoing research projects .. or just musing about the writing process Archives

September 2019

Categories

All

|

Proudly powered by Weebly

RSS Feed

RSS Feed